NGVC Stock: An Organic Inflation Hedge With Room To Grow

Editor’s note: Seeking Alpha is proud to welcome Mana Wright as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

fcafotodigital/E+ via Getty Images

Investment thesis

Natural Grocers by Vitamin Cottage (NYSE:NGVC) have demonstrated their ability to survive and thrive through various business cycles and they appear to be a solid undervalued defensive play for one’s portfolio. With a unique business model, rational management, a growing industry & market opportunity, rising inflation, and a looming potential Ukraine War induced food crisis, NGVC has strong tailwinds driving their growth. According to my DCF model, its implied intrinsic value lies somewhere in the range of $18 (bear case) and $25 (base case). With a current share price of ~$16, this represents a potential upside of 12-55%. If you’re looking for an inflation hedge with a solid defensive profile and good business model with plenty of room to grow, NGVC may be the pick.

Company Overview

Natural Grocers by Vitamin Cottage are an expanding specialty retailer of natural and organic groceries, body care and dietary supplements products. They currently have 162 stores in 20 states across the USA and plan to continue expansion. They operate a unique business model focusing exclusively on natural and organic products free of artificial ingredients and have a strict policy on products they will allow on their shelves.

Excerpt from FY2021 10-k

Employing full-time Nutritional Health Coaches in every store who provide free nutrition coaching and classes for customers, and ongoing education for store associates, NGVC practice what they preach. Given a core component of their expansion plan is to both grow their return customer base and increase the average transaction amount, their commitment to authenticity and transparency gives me confidence in their most recent guidance and their ability to execute.

Earnings

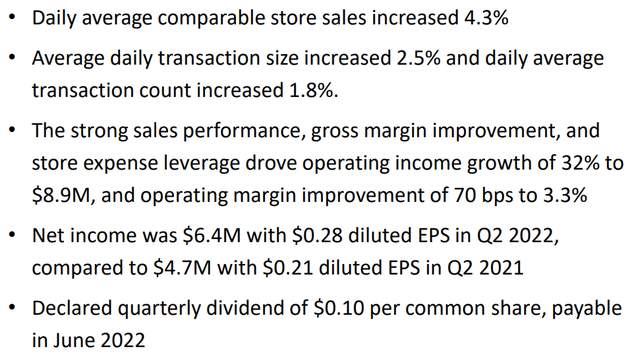

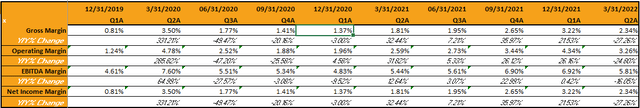

Strong Q2 FY2022 earnings demonstrate NGVC’s ability to execute strategy and deliver on guidance. Though the rate of growth has slowed down in recent quarters and FY2021, this is an expected return to normal after a pandemic related ramp-up in revenues and revenues for FY2021 are significantly up from pre-pandemic levels. Comp sales for Q2 FY2022 are up 13.5% relative to 2019 pre-pandemic levels and relative to Q1, financial metrics for Q2 FY2022 have been strong across the board.

Investor Presentation – May 2022 (Investor Presentation – May 2022)

Market Opportunity

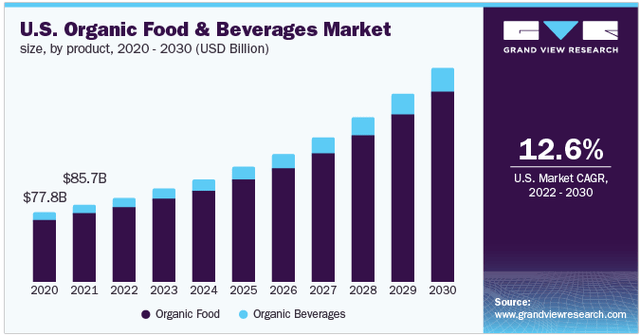

The organic food & beverage market had ~$85 billion in sales in 2021 and is expected to grow at a CAGR of 12.6% through to 2030.

U.S. Organic Food & Beverages Market Outlook (Grandview Research)

Growth here is largely driven by increased consumer focus on high-quality products, nutrition, health & well-being, and sustainability. The COVID-19 pandemic has demonstrated to the world the importance of having a resilient immune system for overall health and to mitigate the severity of symptoms and risk should one get sick. Because of this, consumer focus is shifting toward high-integrity, nutrition and mission-driven companies, like NGVC. The industry is relatively crowded, competition is high, and NGVC is up against some pretty large and established players (Whole Foods, Kroger (KR), Walmart (WMT), Trader Joe’s, Sprouts Farmers Market (SFM), and more); however, NGVC’s continued penetration of the market, growing footprint and expanding top-line and margins indicate they can certainly compete.

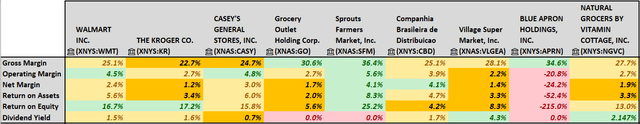

In my comparable analysis (shown below), NGVC comes out strong against its peers, though if you are looking to add only one company from this sector, Sprouts makes a compelling case also and I will be writing an article on their prospects next.

Comparative Analysis (Author’s DCF Model)

Inflationary Pressures

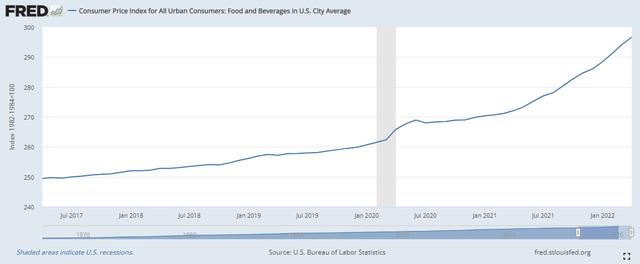

Spending power and the value of many businesses are eroded in high-inflation environments. Due to costs rising faster than their power to pass on to customers through increased pricing, margins get squeezed. Companies who sell consumer staples (think food, commodities, or energy) are positioned to pass on these costs immediately. Their products are extremely inelastic – that is, for an increase in prices, consumers will not reduce their spend by a corresponding amount. Rather they will absorb the additional cost and continue to consume. With this, top lines grow in-line with headline inflation. CPI data from FRED shows an exponential inflation trend for food and beverage in the average US city, with the rate of growth almost tripling over the last two years relative to the prior three.

CPI for All Urban Consumers Food and Beverage in U.S. City Average – 5 Years [FRED]

NGVC is continuing the expansion of their brick-and-mortar footprint though which means they will be establishing new lease agreements during a period of rising real estate prices, a cost they will not as easily be able to pass on to customers.

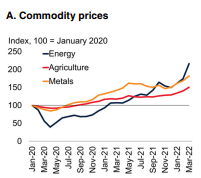

The World Bank reports the War in Ukraine is contributing to “the largest commodity shock we’ve experienced since the 1970s” and prices are up dramatically across commodities, energy, and food.

Commodity Price Growth (World Bank Commodity Markets Outlook Report, April 2022)

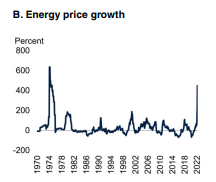

Energy Price Growth (World Bank Commodity Markets Outlook Report, April 2022)

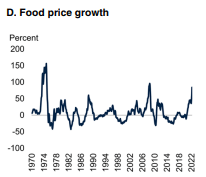

Food Price Growth (World Bank Commodity Markets Outlook Report, April 2022)

While this will impact all companies as consumers begin to pinch pennies, defensive companies like NGVC are better able to weather the storm.

Management Analysis

Most of the executive team are members of the Isely family (founding family) with Zephyr Isely and Kemper Isely acting as Co-Presidents. Kemper joined the company in 1977 and Zephyr in 1969, and both have held positions across the organization as Store Manager and Warehouse Manager. I have not been able to find anything to indicate dishonesty or poor decision-making.

The company issues restricted stock units to management under incentive plans which vest over a 1- to 5-year period or subject to requisite service requirements, thus incentivizing a longer-term focus. Of note though is NGVC’s “controlled company” status within the meaning of the NYSE Listed Company Manual. Because more than 50% of the company is owned by the Isely family, or entities controlled by them, they can enjoy this status and are exempted from certain NYSE standards and corporate governance requirements. Hence why they can have their Board of Directors made up of majority Isely family members. This could impact the company’s ability to raise capital in the future as additional share offerings could dilute their ownership and lose them this status.

I am okay with this and prefer companies where management has skin in the game.

Strategy for Growth

NGVC has outlined a consistent growth strategy in the past few quarters with several primary focus areas:

Operating Efficiency

NGVC aims to improve their operating margins through investment in fixed overhead and technology, leveraging their scalable business model, optimizing the format and size of their new/remodeled stores, and more effectively managing their store labor levels and inventory. Whatever changes they are making, are yet to have the desired impact as margins for Q2 FY22 showed a marked decline from Q1. To their credit, Q2 2022 Margins are up across the board compared to Q2 2021.

Quarterly Margin Analysis (Author’s DCF Model)

Management does note however that new stores take time to get to profitability and may negatively impact company operations until consistent operating scale is reached. Achieving recurring quarterly margin expansion will likely be a catalyst for the market price to converge with implied intrinsic value.

NGVC also has their own Natural Grocers branded products which represented 7.7% of total sales for Q2 FY22, up from 7.2% for FY21. Typically, margins for private-label brands are much higher than that of third-party brands so focusing on expanding the share of sales for theirs is a wise move.

May 2022 Investor Presentation

Expanding Store Base

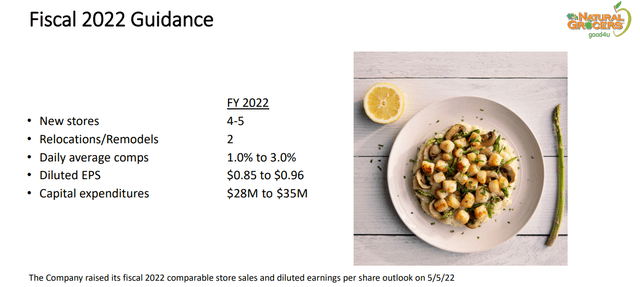

During FY2021 the company opened three new stores. Hampered by the pandemic and supply-chain shortages, this fell short of their guidance of 5-6 new stores, however they appear to be back on track and are confident in their guidance of 4-5 new stores with 2 relocations/remodels for FY2022.

May 2022 Investor Presentation

So far, as of the date of FY2022 Q2 10-Q, they have signed leases or acquired property for an additional six new stores which they plan to open in FY2022 and beyond, and had already opened one new store during April 2022.

Increase Sales from Existing Customers

By growing their customer loyalty program, N Power, and continuing to differentiate themselves with their free nutritional education offerings, strict adherence to organic and natural products policy, and community engagement, NGVC aims to increase the average transaction spend by existing customers. Q2 saw a 2.5% increase in daily average transaction size and a 1.8% increase in daily average transaction count – moving in the right direction.

Expanding Customer Base

NGVC took several measures during FY2021 to enhance brand awareness including:

- Implementing marketing outreach efforts to inform customers of in-store Covid health & safety measures

- Featuring new N Power promotions to highlight affordable family meals

- Utilizing N Power to identify and send personalized offers to customers

- Continuing to enhance monthly Health Hotline magazine

- Organizing month-long topical promotions

- Increasing investment in social media advertising

- Conducting television, radio, and outdoor advertising as well as targeted direct mail campaigns, and,

- Continuing to offer home delivery services

NGVC actively participates in their communities and has community rooms and demonstration kitchens in most of their stores. They also select sites for their new stores in prime locations with easy customer access and high visibility often near other supermarkets or gourmet food retailers complementing their more conventional offerings with NGVC’s high-quality, affordable, natural and organic groceries and dietary supplements.

Risks

NGVC outline a wide-range of risks to consider in their FY2021 10-K, some of which I will discuss briefly.

Inflation

Though the nature of their business offers a natural hedge against inflation, it is possible their ability to pass through price increases to customers may not be able to keep up with the rate of inflation, negatively impacting margins in the process.

Competitive Market

Their market is highly competitive and has low barriers to entry. I believe they are well-positioned to leverage their reputation and scalable operations however it is a crowded commodity-based market making it possible for others to capture market share.

Supply Chain

Supply chain issues and a food-crisis in Ukraine dance a fine line of opportunity and risk for NGVC. A reduction in supply with steady demand should enable them to increase their prices but this will only make up for a reduction in volume to a point. Expanding on this, NGVC depends on one supplier for ~67% of total purchases and a disruption for that supplier could have a dramatic impact on operations.

Energy Costs

Energy costs are a significant component of operating expenses and per the World Bank, energy costs are rising internationally at an exponential rate (see graph used above)

Significant Lease Obligations

Significant lease obligations require high cash flow to satisfy which could create liquidity problems and require additional debt or capital raising. Given the unfavorable position they may be in should they need to raise or issue debt, it’s possible this may be done on unsatisfactory terms. Further, the company is limited in its ability to issue equity due to its controlled company status requiring 50% ownership by the Isely family.

Valuation

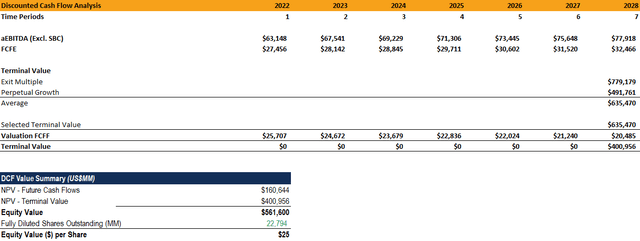

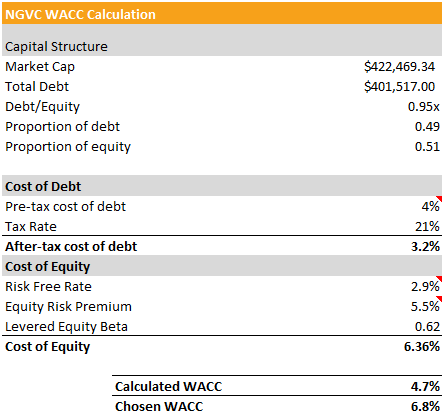

Using what I believe are relatively conservative assumptions, my DCF analysis shows an implied intrinsic value in the range of $18 (bear case) and $25 (base case). This is based on 4% top line growth for FY22 (given Q1 and Q2 earnings, I extrapolated FY22 earnings of $1,098,220,000 which is ~4% up from FY21) then reducing to 2.5% for 2023 through to 2028 as well as constant 6% adjusted EBITDA margins. This results in the annual free cash flows stated below. Using a terminal value based on the average of a 10x EV/EBITDA exit multiple terminal value and a 3% long-term perpetual growth rate terminal value, and discounting using WACC of 6.8%, I calculated an equity value of $561,600,000 or $25 per share.

Implied Intrinsic Value, Base Case (Author’s DCF Model)

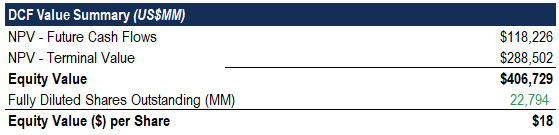

The downside case, which is just the base case*0.75 (reduced top-line growth and aEBITDA margins), results in the below equity value and equity value per share

Implied Intrinsic Value, Bear Case (Author’s DCF Model)

I place a very low possibility on this however, and I believe management will be able to continue their growth trajectory and achieve the base case.

Also, my WACC calculations yielded a WACC of 4.8%, I added 200bps for conservatism’s sake as intuitively, 4.8% felt too low.

Author’s WACC Caculation (Author’s DCF Model)

With a current price of ~$16, the base case represents a potential upside of ~55% and the bear case ~12%.

Key Takeaways

NGVC is a unique business operating in a rapidly growing industry with strong tailwinds. They have a long record of sustainable growth and resilience, having survived and grown through all market cycles in the last ~60 years. Consumers in this market place great importance on integrity and authenticity and NGVC adheres strictly to their promise to provide organic and natural products and this will generate significant goodwill for them in the longrun. The management team have been with the company for 4-5 decades on average and own more than 50% of the company – Safe to say they have skin in the game.

Currently only trading at 5.69x TTM cash flow, there is a lot of room to grow for this company. Should they show consistent quarterly growth and even only maintain EBITDA margins at ~6%, share price should ultimately converge to the implied intrinsic value, offering a long-term upside of ~55%. With food prices undoubtedly on the rise and inflation eroding value, NGVC could be the perfect hedge for your portfolio.